Fun with Stock Screeners - Part 2

We continue with this series of write ups aiming to identify listed companies that may be good investment choices.

Part 1 can be referred to here:

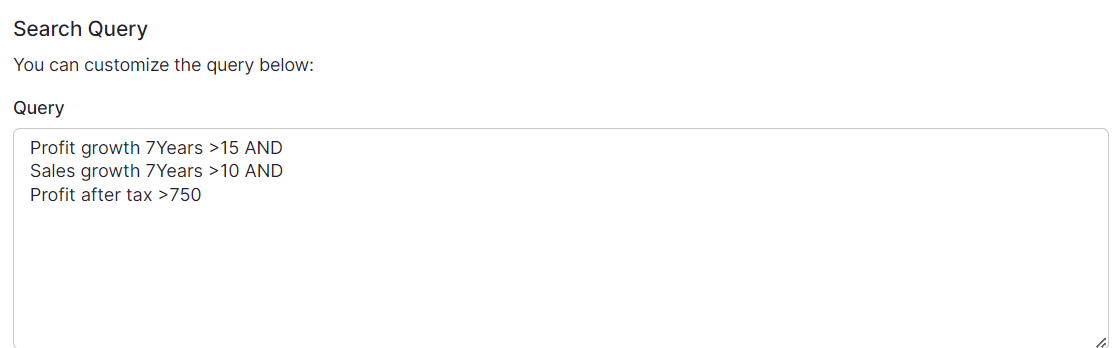

Today's screener prompt was quite simple,

Pull out those companies that have seen their profits grow at a CAGR of 15% over 7 years, Sales grow over 10% for the same period and have posted profits of at least INR 750 Cr in the last financial year (FY22).

This query threw up quite a few companies but one has caught my eye.

Redington Limited: Most famously known as a distributer for Apple Products in India.

I find these stats interesting and warrantying a closer look from an investment point of view

10 Year CAGR Sales - 11%

10 Year CAGR PAT - 16%

10 Year CAGR Price - 16%

Return on Equity (10 Year period) - 17%

Debt to Equity - 0.3 (approx.)

Promoter Holding; NIL (Essentially not large enough to come under the definition)

At a 12 TTM PE of around 10, the company seems to be undervalued. Again, please note that these are preliminary observations but the aim of these activities is to use screeners to pull out potential hidden gems.

Disclaimer: I have a small investment in this company which I may increase in the near future (currently giving me ~50% returns in under 1 year)