Sula Vinyard IPO - Hot or Not?

Let’s come straight to the question - Should one apply for the Sula Vinyard IPO?

For new readers, a good starting point would be my first article on this site

Now, Im assuming the reader is upto speed. Lets get back to the question

Now, Im assuming the reader is up to speed. Let’s get back to the question

Step 1: Look at the GMP.

A good place to check GMP related data would be https://www.chittorgarh.com/or its affiliate websites. A lot of ads to be sure, but they have a good set of data.

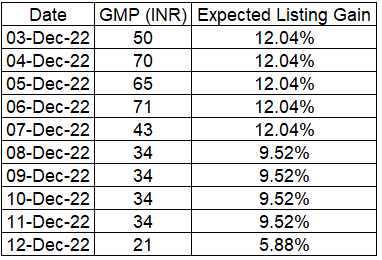

For Sula, lets have a look at how the GMP has moved over the last few days

Considering its just the starting of the 2-day process, the GMP isn’t very encouraging. It appears to have fallen drastically from a week ago signifying lacklustre interest in the Grey Market.

Step 2: Subscription status

While it’s too early to conclude anything about subscription (interest), we see retail subscription at 0.48x of allotment while the Big Boys (Qualified Institutional Buyers - QIBs) haven’t entered the fray yet (I don’t see large QIB subscription but will update this article on 14th to reflect the situation better)

Step 3: IPO Timeline - Blockage of Funds

Readers should remember that should they be allotted shares; the actual listing is nearly a week away (~21 Dec). And in this time, the GMP could disappear altogether.

IPO closing: Dec 14

IPO Allotment: Dec 19

IPO Listing: Dec 21

Conclusion:

With GMP at around 6% and a long waiting period, I personally do not find this IPO to be worth applying to. The GMP has been volatile and I do not want to my funds stuck in what seems to be a damp listing.

Disclaimer: These are my personal views and not financial advice of any kind. These are my steps to assess for potential listing gains and they do not include any kind of fundamental or technical analysis of the company in question. Nor is it a comment on long term performance of the soon to be listed stock.